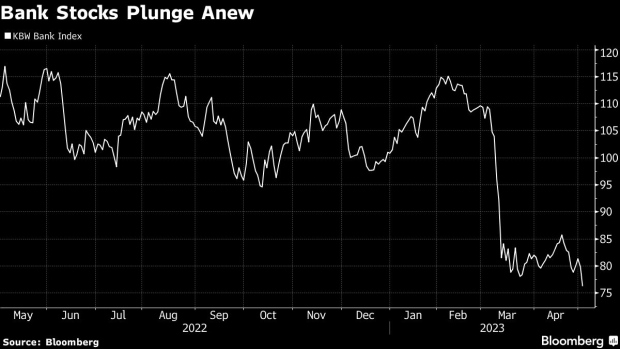

Governments around the globe are stepping in with extraordinary rescue plans to keep the banking system stable. It’s not yet clear if they’re succeeding.

US regulators orchestrated a $30 billion cash infusion into First Republic Bank, a regional bank with a similar profile to the failed Silicon Valley Bank. That calmed nerves late Thursday. But First Republic’s stock was down another 14% Friday in premarket trading. Other regionals, including Western Alliance and PacWest were also lower, and Reuters reported that PacWest was working to get a deal similar to First Republic’s.

Meanwhile, investors remained skeptical of Credit Suisse’s ability to stay afloat. The stock fell another 5% in morning trade, as rumors of a takeover – either by UBS or the government – continued to swirl.

The chaos spread to China, whose central bank made a surprise cut to the amount of money that banks must keep in reserve, an effort to keep money flowing through the financial system.

Regulators continue to insist that the banking system is stable. But the Federal Reserve loaned out $150 billion to banks last week, including $12 billion in its new emergency lending program. We’re nowhere close to what banks were borrowing during the global financial crisis – but that’s still a lot of money.

“The glass half-empty view is that banks need a lot of money,” said JPMorgan’s Michael Feroli in a note to investors. “The glass half-full take is that the system is working as intended.”

We’ll watch closely to see if more banks fail Friday after the market close. This has proven to be a volatile situation, and emotion can turn on a dime.